Community Involvement

We’re Proud to Serve the Communities We Call Home.

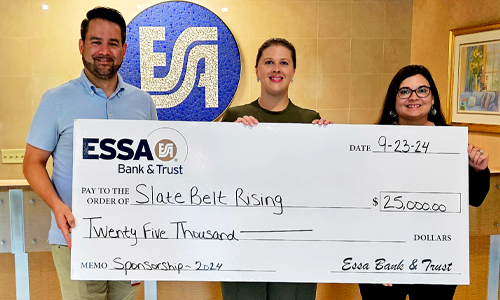

At ESSA Bank, our greatest investment will always be in the people and places we serve. We truly care about the growth, well being, and success of our local communities. To us, banking means more than offering financial services, it means giving back, supporting our communities, and being there as partners every step of the way.

From charitable contributions and sponsorships to volunteerism and financial education, we’re proud to help build a stronger future right here at home. Where we live, work, and grow together.

If your organization would like to request community support, including donations or sponsorship opportunities, please review our Donation Policy and submit your request to your local ESSA office.

Because community isn’t just part of our mission, it’s who we are.

We’re Proud to Serve the Communities We Call Home.

ESSA Partnerships

RiseUp Program

RiseUp Fund, a nonprofit founded by Houwzer to help underserved families achieve homeownership, is supported by ESSA Bank as part of our commitment to strengthening local communities. RiseUp provides low-income families in Delaware County, Pennsylvania with meaningful pathways to homeownership, including financial assistance toward closing costs, HUD-certified education, and one-on-one housing counseling.

The program focuses on ALICE (Asset Limited, Income Constrained, Employed) households, helping individuals and families prepare for the homebuying process and succeed as first-time homeowners. All programs are offered at no cost in Philadelphia and surrounding counties.

CALV Program

ESSA partners with Community Action Lehigh Valley (CALV), which combats poverty by providing access to economic opportunities through advocacy, business development, food access, housing, neighborhood revitalization, and youth programs.

CALV’s HUD-certified housing counselors help credit- and income-eligible renters become first-time homeowners, stimulating the local economy.

Through CALV’s Home Ownership Savings Account Program, eligible participants open savings accounts at ESSA with a 1:1 match up to $2,000, waived minimum balance requirements, and variable interest rates.

Pocono Mountains United Way

ESSA partners with Pocono Mountains United Way in a Matched Savings Account Program to help low-income individuals and families become homeowners, small business owners, or post-secondary graduates.

The program provides matched savings incentives, financial literacy classes, and counseling. ESSA contributes $5,000 annually for three years, offering qualified participants a 1:1 match up to $1,500. Participants open savings accounts at ESSA with waived minimum balance requirements and variable interest rates.

ESSA employees also provide financial literacy education modeled after the FDIC’s Money Smart Program and make yearly donations to support PMUW’s efforts.

ESSA Bank’s Commitment to Second Chances: Supporting Reentry Through Financial Empowerment

Rebuilding a life after incarceration is no small feat, but ESSA Bank believes that with the right resources and support, transformation is possible. That’s why ESSA is proud to partner with multiple reentry programs across Pennsylvania, providing formerly incarcerated individuals with the financial tools and education needed to reintegrate into society with dignity and direction.

Our Partnerships

STRIVE Program

In partnership with the Commonwealth of Pennsylvania Department of Corrections and participating correctional facilities

CARE Program

Court Assisted Re-Entry, in collaboration with the U.S. District Court for the Middle District of Pennsylvania

STAR Program

Supervision to Aid Re-Entry, in collaboration with the U.S. District Court for the Eastern District of Pennsylvania

Financial Support That Removes Barriers

Through these programs, ESSA offers eligible participants and graduates access to loans of up to $15,000. These funds are designed to help cover critical reentry needs such as:

Financial Literacy: The Foundation for Lasting Change

Financial support is just the beginning. To qualify for a loan, participants must complete a comprehensive Financial Literacy Program. STRIVE and CARE participants engage with ESSA’s curriculum based on the FDIC’s Money Smart Program, while STAR participants complete training through The Fox School of Business at Temple University. These rigorous courses equip individuals with essential financial knowledge and skills to confidently manage their personal finances and build a stable future.

Our Belief

By investing in these reentry programs, ESSA Bank is reinforcing its commitment to redemption, resilience, and the transformative power of financial education. We believe that financial knowledge paired with opportunity creates lasting change—and that everyone deserves a chance to build a better future.