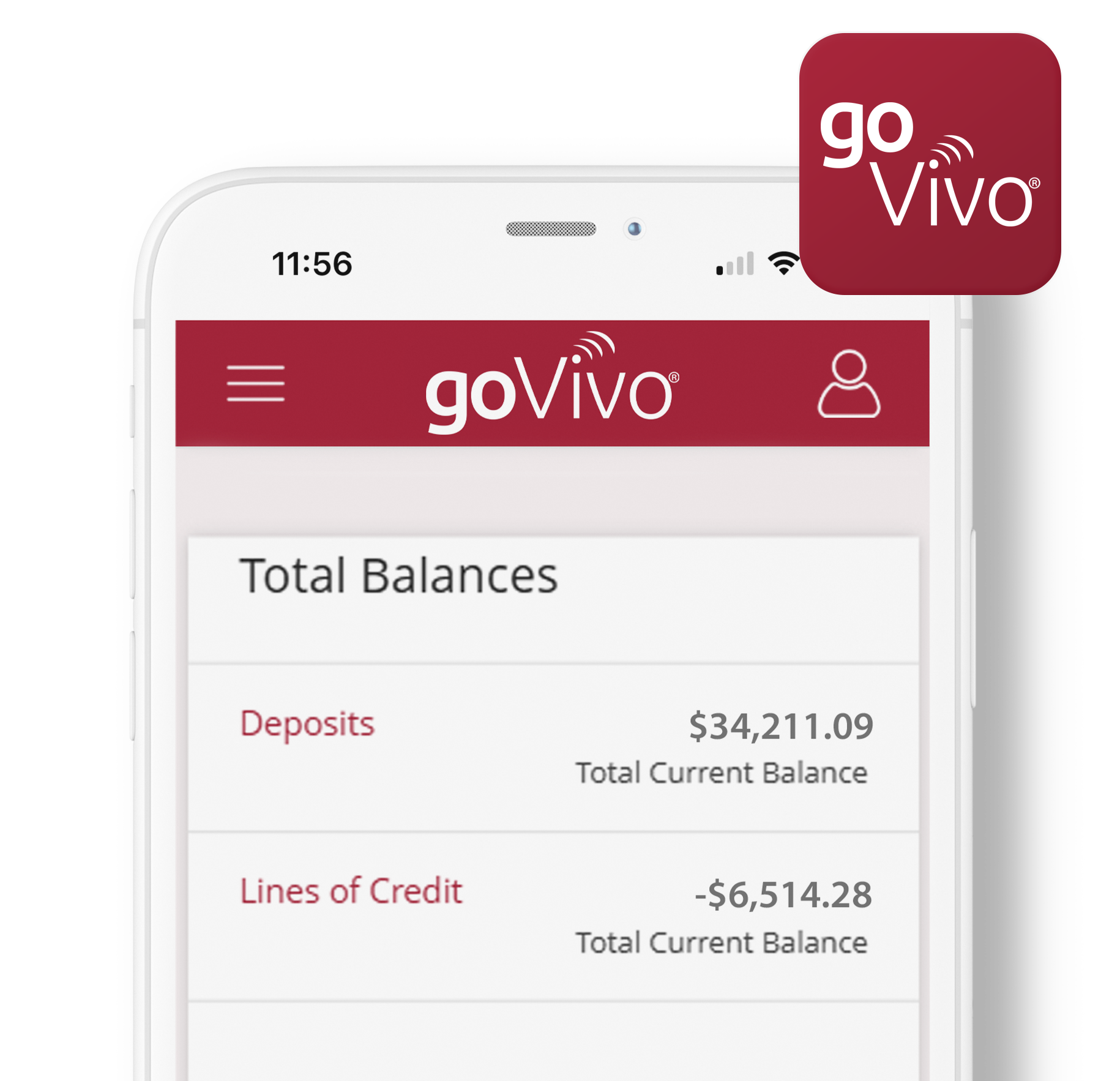

goVivo® for Businesses

Online & Mobile Banking for Your Business

goVivo® makes it possible for you to securely access your business financial accounts on the go. We use the latest technology to ensure your information is protected. No matter where you are or what mobile device you use, you have the convenience and flexibility to manage your business accounts from your mobile device.

Complete Business eBanking Platform

Enjoy 24/7 online access for all your business banking needs. Our comprehensive eBanking platform empowers you to manage every aspect of your business finances efficiently.

Payment Management

- Originate direct deposit of payroll checks with ACH capabilities

- Pay and receive unlimited monthly bills with Bill Pay

- Schedule recurring payments

- Receive eBills electronically

Financial Control

- Set up user permissions for employees

- Add, delete, or modify access levels

- Control administrative task delegation

- Monitor all account activity

Accounting Integration

- Reconcile accounts through Quicken, QuickBooks, Excel and more

- Enroll for eStatement to view your statement history – it’s free!

Do all of this yourself or set up specified authorization for specific personnel within your company to handle certain portions of the administrative tasks. The ability to add, delete or modify user permissions allows you control over employee access to eBanking.

Choose the level of Business eBanking that best fits your needs:

| Features | Standard Package | Enhanced Package | Full-Service Package |

|---|---|---|---|

| Find summary balances for all accounts | ✓ | ✓ | ✓ |

| View detailed account activity for any particular day or over a period of time | ✓ | ✓ | ✓ |

| View the details of a specific transaction | ✓ | ✓ | ✓ |

| View or print an image of the check | ✓ | ✓ | ✓ |

| View or print an image of a deposit and the items within the deposit | ✓ | ✓ | ✓ |

| Transfer money between accounts | ✓ | ✓ | ✓ |

| Manage your daily check disbursement activities | ✓ | ✓ | ✓ |

| Request stop payment on a check or range of checks | ✓ | ✓ | ✓ |

| Send and receive secure messages to and from Impressia Bank regarding your deposit or loan accounts | ✓ | ✓ | ✓ |

Perform various administrative functions relating to your accounts:

|

✓ | ✓ | ✓ |

| Create and edit balance alerts | ✓ | ✓ | ✓ |

| Includes security tokens | ✓ | ✓ | |

| Originate ACH credit transactions | ✓ | ✓ | |

| Enjoy higher mobile deposit limits* | ✓ | ✓ | |

| Have a customized mobile deposit limit* | ✓ | ||

| Initiate wire transfers (fees apply) | ✓ | ||

| Originate ACH debit and credit transactions | ✓ |

Choose the level of Business eBanking that best fits your needs:

What you need to know about Business eBanking:

- You must have an ESSA Bank business checking account assigned as the primary account.

- Cut off Times: Internal transfers initiated through ESSA Bank Business eBanking are posted live. External transfers initiated before 5:00 p.m. EST will have second business day availability. Your daily transfer limit will be determined at the time of application. Cut off time for wire transfer requests is 3:00 p.m. EST. Cut off time for stop payment requests is 3:00 p.m. EST.